Financial wellness for college students means learning how to handle money in a smart and healthy way. It focuses on budgeting income, saving small amounts, and managing daily expenses. This approach helps students stay in control of their finances. It also reduces money worries during college life.

College life can feel stressful when money runs out too fast. Many students struggle with spending, bills, and unexpected costs. One small money mistake can affect the whole month. That’s why financial wellness matters more than ever.

With the right money habits, students can budget smarter and save more. Simple planning helps avoid debt and last-minute stress. Financial wellness builds confidence and peace of mind. It prepares students for a stable financial future.

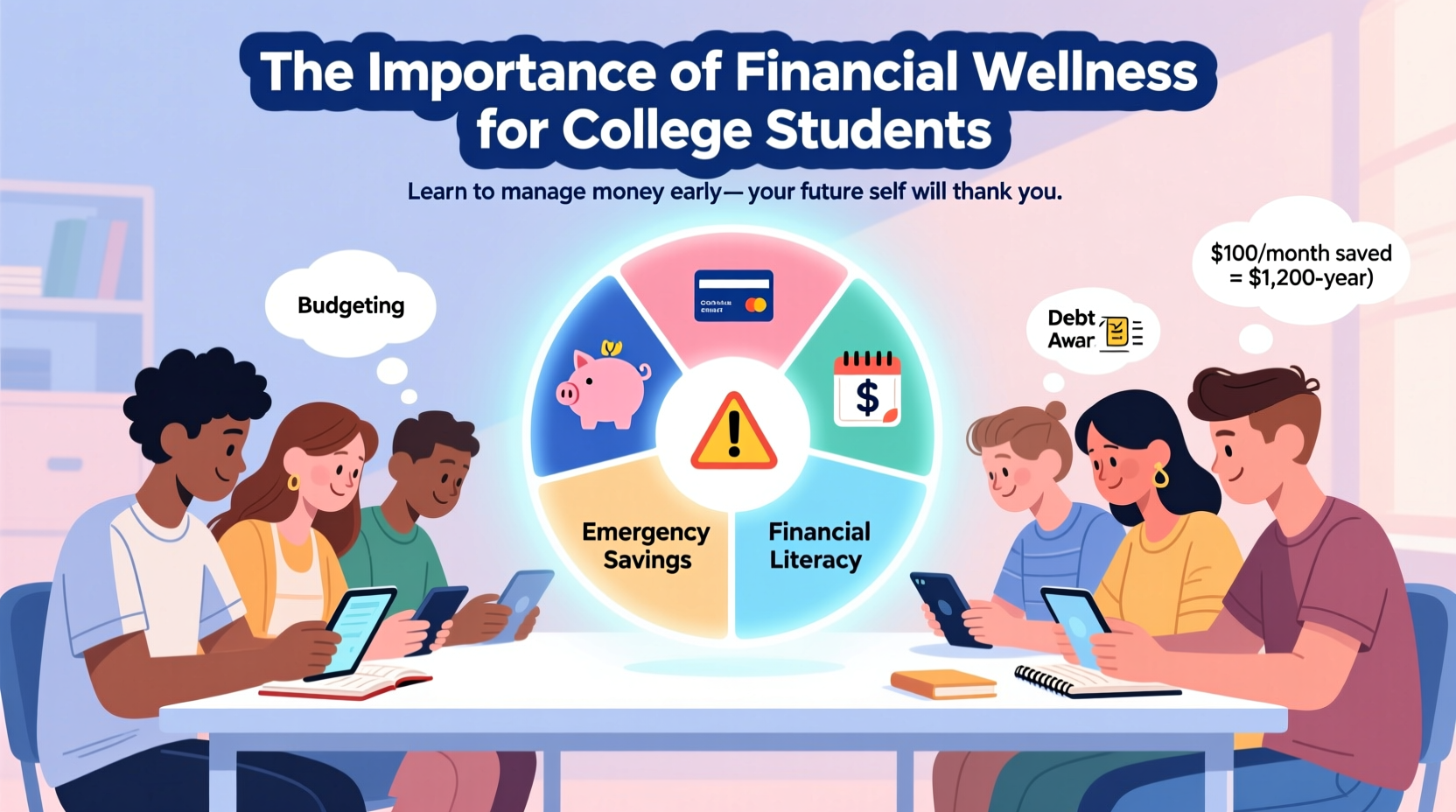

The Importance of Financial Wellness for College Students

Financial wellness is very important for college students. It builds smart money habits and strong discipline. Students learn budgeting, saving, and expense control. Financial services support daily money needs and planning. Clear financial plans guide spending and goals. These habits reduce stress and improve focus. Financial services also teach responsibility and confidence during college life.

Strong money skills prepare students for the future. Students understand financial plans for short-term and long-term needs. Learning about social security benefits builds early awareness and security. Knowledge of social security benefits supports future stability. These skills help students avoid debt and mistakes. Students gain balance, independence, and success after college.

Key Areas of Financial Wellness for College Students

| Key Area of Financial Wellness | Why It Is Important for College Students |

| Budgeting Skills | Budgeting helps college students manage income and control monthly spending. |

| Saving Habits | Saving money builds financial security and prepares students for emergencies. |

| Expense Tracking | Tracking expenses shows spending patterns and reduces money waste. |

| Debt Awareness | Debt awareness helps students avoid unnecessary loans and future pressure. |

| Income Management | Managing part-time income improves financial balance during college life. |

| Emergency Fund Planning | An emergency fund protects students from unexpected expenses. |

| Financial Goal Setting | Clear financial goals support both short-term and long-term planning. |

| Smart Spending Choices | Smart spending helps students focus on needs instead of wants. |

| Credit Knowledge | Understanding credit cards and scores supports future financial health. |

| Bill and Payment Management | Paying bills on time prevents penalties and builds discipline. |

| Money Mindset Development | A healthy money mindset reduces stress and builds confidence. |

| Financial Education Skills | Financial education prepares students for life after college. |

Steps to Improve Financial Wellness as a College Student

College students can improve financial wellness with simple steps. They should track income and control expenses. Budgeting builds discipline and balance. Financial services help students manage money safely. Learning wealth management builds smart habits early. Financial advisors offer guidance and support. Financial companies provide tools for saving and planning.

Saving small amounts strengthens financial wellness. Students should set clear goals and follow them. Financial services support daily money control. Wealth management helps protect future income. Financial advisors guide smart decisions. Retirement plans teach long-term thinking. Financial companies explain retirement plans clearly. These steps reduce stress and build confidence.

Why Financial Wellness Matters for College Students

Financial wellness matters for college students because it builds smart money habits. It supports budgeting, saving, and expense control. These skills reduce stress. They improve focus, discipline, and confidence. Financial wellness prepares students for a stable academic life and future success.

It connects financial services, social security benefits, financial plans, wealth management, financial advisors, financial planners, retirement plans, financial companies, chartered financial planners (CFP), tax planning, asset management companies, financial consulting, business consulting, and business consulting firms. These keywords matter because they represent essential money skills, planning tools, professional guidance, and protection services that help students build financial literacy, manage risks, plan for the future, and achieve long-term financial stability with confidence.

How Financial Wellness Helps College Students Budget Smarter and Save More

Financial wellness helps college students manage money in a smart way. It teaches clear budgeting skills and careful spending habits. Students track income and control expenses. A simple budget prevents waste and confusion. Financial services and wealth management support daily needs. Financial advisors guide students toward better decisions.

Saving money becomes easier with strong habits and planning. Students set small saving goals and follow them daily. Financial services explain retirement plans and long-term goals. Wealth management supports future stability. Financial advisors work with financial companies to explain retirement plans. These skills reduce stress and build a secure financial future.

Financial Wellness for College Students: Simple Money Habits That Reduce Stress

Financial wellness helps college students manage money with care and discipline. Simple money habits create control and balance. Students track spending and plan a clear budget. Financial services and wealth management support daily needs. Financial advisors guide smart choices with help from financial companies. These habits reduce pressure and support focus and responsibility.

Regular budgeting keeps expenses within limits. Saving small amounts builds long-term strength. Planned spending avoids stress and shortages. Financial services explain retirement plans clearly. Wealth management and financial advisors support retirement plans through trusted financial companies. These habits protect students from debt. They build peace of mind, stability, and a secure future after college.

Smart Budgeting and Saving Tips to Improve Financial Wellness in College

Smart budgeting helps college students control money every month. Students should list income and daily expenses. A simple budget shows spending limits clearly. Tracking costs prevents waste and confusion. Budgeting builds discipline and focus. These habits support strong financial wellness during college life.

Saving money improves financial wellness and confidence. Students should save small amounts regularly. Even small savings create safety and balance. Planned spending reduces stress and sudden shortages. Avoiding unnecessary purchases protects income. These smart budgeting and saving tips support stability. They prepare students for responsible money management after college.

Financial Wellness for Students: Budgeting, Saving and Managing Expenses

Financial wellness helps students handle money with care. It includes budgeting, saving, and managing expenses. Students plan income and control spending clearly. Financial services support daily needs and smart choices. Wealth management builds discipline and balance. Financial advisors guide planning with help from financial companies and basic retirement plans.

Saving small amounts creates safety and confidence. Expense tracking shows where money goes. Students avoid debt and stress. Financial services explain goals and spending limits. Wealth management supports future growth. Financial advisors from financial companies explain retirement plans. These habits support stability, focus, and long-term success after college.

FAQ’s

What is financial wellness for students?

Financial wellness means managing money in a smart and healthy way. It includes budgeting, saving, and controlling expenses.

Why is budgeting important for students?

Budgeting helps students plan income and avoid overspending. It keeps money under control.

How can students start saving money?

Students can save small amounts regularly. Even small savings build financial safety.

How does expense tracking help students?

Expense tracking shows where money goes each day. It helps reduce waste.

Can financial wellness reduce stress for students?

Yes, good money habits reduce stress. Students feel more confident and secure.

How can students manage expenses better?

Students should plan spending and avoid unnecessary purchases. This improves balance.

What skills improve student financial wellness?

Budgeting, saving, and planning skills improve financial wellness. These habits support long-term stability.

Conclusion

Financial wellness for students builds strong money habits that last beyond college life. Budgeting, saving, and managing expenses create control and confidence. These skills reduce stress and support academic focus. Students learn discipline and responsibility through daily money decisions.

Simple financial habits lead to long-term stability and success. Regular saving and planned spending protect students from debt. Financial wellness prepares students for future goals and independence. Strong money management supports a balanced and secure financial future.

Ibrahim is an experienced blogger with 5 years in wellness, gratitude, and blessings content creation. He inspires readers worldwide through mindful living and spiritual wellness insights, continuing his mission at PeacefulBlessing.com your trusted source for positivity and peaceful living.